All Categories

Featured

Table of Contents

[/image][=video]

[/video]

The policy gets value according to a dealt with routine, and there are fewer costs than an IUL policy. A variable plan's cash worth might depend on the efficiency of details supplies or other securities, and your costs can likewise change.

An indexed universal life insurance policy plan consists of a survivor benefit, in addition to an element that is tied to a stock exchange index. The money value growth relies on the performance of that index. These policies offer higher prospective returns than other kinds of life insurance policy, along with higher dangers and additional costs.

A 401(k) has even more investment choices to select from and might include a company suit. On the various other hand, an IUL features a fatality advantage and an additional money worth that the policyholder can borrow against. They likewise come with high costs and fees, and unlike a 401(k), they can be terminated if the insured quits paying right into them.

However, these plans can be extra complicated compared to various other kinds of life insurance coverage, and they aren't always appropriate for each investor. Speaking to a knowledgeable life insurance policy agent or broker can help you determine if indexed universal life insurance policy is an excellent fit for you. Investopedia does not provide tax, financial investment, or economic solutions and guidance.

Best Indexed Universal Life Insurance Policies

IUL plan motorcyclists and modification alternatives permit you to tailor the plan by boosting the death advantage, including living benefits, or accessing cash money value earlier. Indexed Universal Life Insurance Coverage (IUL Insurance Coverage) is a long-term life insurance policy offering both a survivor benefit and a money value part. What sets it in addition to various other life insurance policy plans is exactly how it manages the investment side of the money worth.

It's crucial to note that your cash is not straight bought the stock exchange. You can take money from your IUL anytime, yet fees and surrender fees might be connected with doing so. If you require to access the funds in your IUL plan, considering the advantages and disadvantages of a withdrawal or a funding is essential.

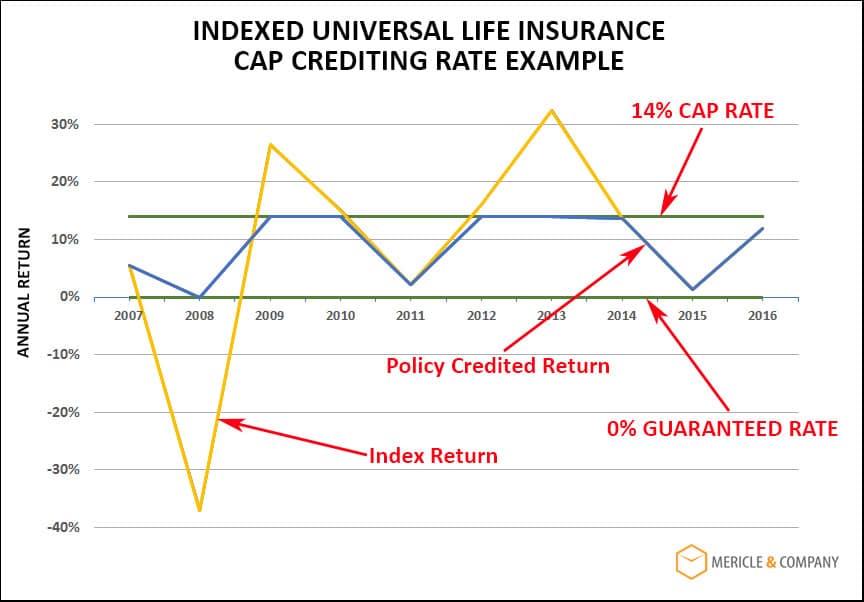

Unlike straight investments in the securities market, your cash value is not straight bought the underlying index. Instead, the insurance policy firm utilizes financial tools like choices to connect your money worth development to the index's efficiency. One of the special attributes of IUL is the cap and floor rates.

Index Universal Life Insurance Australia

The death benefit can be a set amount or can include the money value, depending on the plan's framework. The cash money worth in an IUL policy grows on a tax-deferred basis.

Always review the policy's details and seek advice from an insurance policy specialist to totally comprehend the benefits, limitations, and costs. An Indexed Universal Life Insurance coverage policy (IUL) uses a distinct mix of attributes that can make it an eye-catching option for particular people. Below are some of the vital advantages:: One of the most appealing aspects of IUL is the capacity for greater returns contrasted to other kinds of irreversible life insurance policy.

Withdrawing or taking a funding from your plan may reduce its cash money value, death benefit, and have tax implications.: For those interested in heritage planning, IUL can be structured to give a tax-efficient means to pass wealth to the future generation. The survivor benefit can cover estate tax obligations, and the money value can be an added inheritance.

While Indexed Universal Life Insurance Policy (IUL) uses a series of advantages, it's essential to think about the potential disadvantages to make an informed decision. Below are some of the vital downsides: IUL plans are much more complex than typical term life insurance coverage policies or whole life insurance policy plans. Comprehending just how the cash money value is connected to a securities market index and the ramifications of cap and floor prices can be challenging for the ordinary consumer.

What Is An Index Universal Life Insurance Policy

The costs cover not only the cost of the insurance however likewise management fees and the investment part, making it a more expensive choice. While the cash money worth has the capacity for development based upon a supply market index, that development is usually capped. If the index does exceptionally well in a provided year, your gains will be restricted to the cap rate specified in your plan.

: Adding optional attributes or cyclists can raise the cost.: Exactly how the policy is structured, consisting of how the cash money value is assigned, can also influence the cost.: Various insurer have various prices versions, so going shopping about is wise.: These are costs for handling the policy and are usually subtracted from the money worth.

: The expenses can be comparable, yet IUL uses a floor to help shield against market recessions, which variable life insurance policy policies typically do not. It isn't very easy to provide a specific cost without a specific quote, as prices can differ substantially between insurance coverage suppliers and private scenarios. It's critical to balance the importance of life insurance coverage and the need for added protection it provides with possibly greater costs.

They can aid you comprehend the expenses and whether an IUL plan lines up with your financial objectives and requirements. Whether Indexed Universal Life Insurance (IUL) is "worth it" is subjective and relies on your financial goals, threat resistance, and lasting planning needs. Below are some factors to think about:: If you're trying to find a long-lasting financial investment vehicle that gives a survivor benefit, IUL can be a good alternative.

Secure your enjoyed ones and conserve for retired life at the very same time with Indexed Universal Life Insurance Coverage.

Iul Insurance Meaning

Indexed Universal Life (IUL) insurance coverage is a kind of irreversible life insurance policy policy that combines the features of traditional universal life insurance with the possibility for cash worth growth linked to the efficiency of a securities market index, such as the S&P 500. Like other forms of permanent life insurance policy, IUL gives a survivor benefit that pays out to the beneficiaries when the insured dies.

Money worth build-up: A section of the costs settlements goes right into a cash value account, which makes passion gradually. This cash money worth can be accessed or obtained versus during the insurance holder's life time. Indexing option: IUL policies provide the opportunity for cash money value development based on the performance of a stock market index.

As with all life insurance policy products, there is also a set of threats that insurance holders ought to understand before considering this sort of plan: Market danger: Among the key dangers connected with IUL is market risk. Given that the cash money worth development is linked to the efficiency of a supply market index, if the index does poorly, the cash worth may not expand as anticipated.

Indexed Universal Life Insurance

Enough liquidity: Policyholders ought to have a steady financial situation and be comfy with the premium payment needs of the IUL policy. IUL enables flexible costs repayments within certain restrictions, but it's important to maintain the plan to guarantee it attains its desired goals. Interest in life insurance policy coverage: People who require life insurance protection and an interest in cash worth growth might find IUL appealing.

Candidates for IUL ought to be able to recognize the technicians of the policy. IUL might not be the very best choice for people with a high resistance for market danger, those that prioritize inexpensive investments, or those with more immediate monetary demands. Consulting with a certified monetary advisor that can offer customized assistance is vital before taking into consideration an IUL policy.

All registrants will receive a calendar invite and web link to join the webinar by means of Zoom. Can't make it live? Register anyway and we'll send you a recording of the presentation the following day.

Iul Retirement Pros And Cons

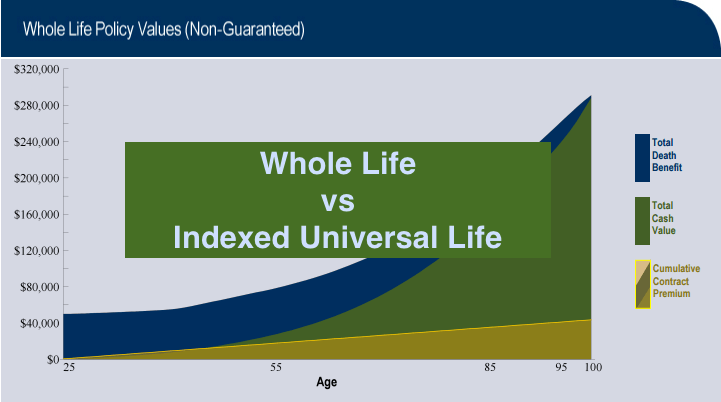

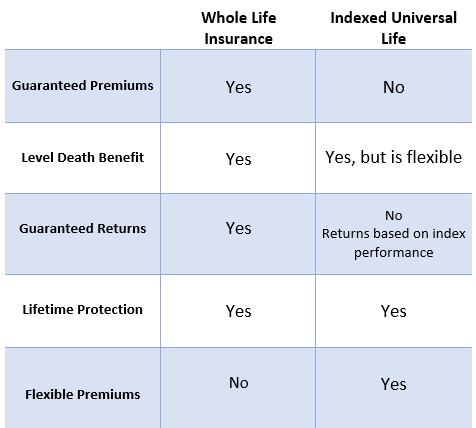

A whole life insurance plan covers you for life. It has money worth that expands at a fixed rate of interest and is the most typical kind of irreversible life insurance policy. Indexed universal life insurance policy is additionally long-term, but it's a certain type of universal life insurance policy with cash money value tied to a securities market index's performance instead of non-equity made rates. Insurance policy holders can shed money in these products. Policy lendings and withdrawals may develop a damaging tax lead to the event of gap or plan surrender, and will certainly reduce both the surrender value and survivor benefit. Withdrawals may undergo tax within the first fifteen years of the contract. Customers ought to consult their tax obligation advisor when thinking about taking a plan financing.

It needs to not be taken into consideration financial investment suggestions, nor does it constitute a recommendation that anyone participate in (or avoid) a particular strategy. Securian Financial Team, and its subsidiaries, have a monetary passion in the sale of their items. Minnesota Life Insurance Coverage Company and Securian Life Insurance policy Business are subsidiaries of Securian Financial Group, Inc.

On the occasion that you pick not to do so, you need to take into consideration whether the item in concern is suitable for you. This website is not an agreement of insurance coverage. Please describe the policy contract for the precise conditions, particular information and exclusions. The policy stated in this webpage are protected under the Policy Proprietors' Protection Scheme which is administered by the Singapore Deposit Insurance Coverage Company (SDIC).

For even more details on the kinds of advantages that are covered under the plan in addition to the restrictions of coverage, where suitable, please call us or see the Life insurance policy Association, Singapore or SDIC internet sites () or (www.sdic.org.sg). This ad has not been evaluated by the Monetary Authority of Singapore.

Table of Contents

Latest Posts

Iul Life Insurance Reddit

Iul Policy Reviews

Iul Leads

More

Latest Posts

Iul Life Insurance Reddit

Iul Policy Reviews

Iul Leads